Americans Student Loan Borrowers Face Resumption of Payments Amidst Mounting Debt Crisis

Examining the Burden, Demographics, and Impact of Student Loan Debt

End of the Payment Pause

After a prolonged three-and-a-half-year hiatus from federal student loan payments, an estimated 44 million borrowers in the U.S. are gearing up to restart loan repayments. As they navigate this transition, significant challenges loom large, amplifying concerns over the ballooning student debt crisis.

Hopes Dashed for Loan Forgiveness

The resurgence of student loan payments dashes the hopes of many borrowers who had anticipated some form of debt forgiveness. An ambitious $400 billion forgiveness plan announced in August 2022, which aimed to alleviate the burden on borrowers, ultimately met its demise.

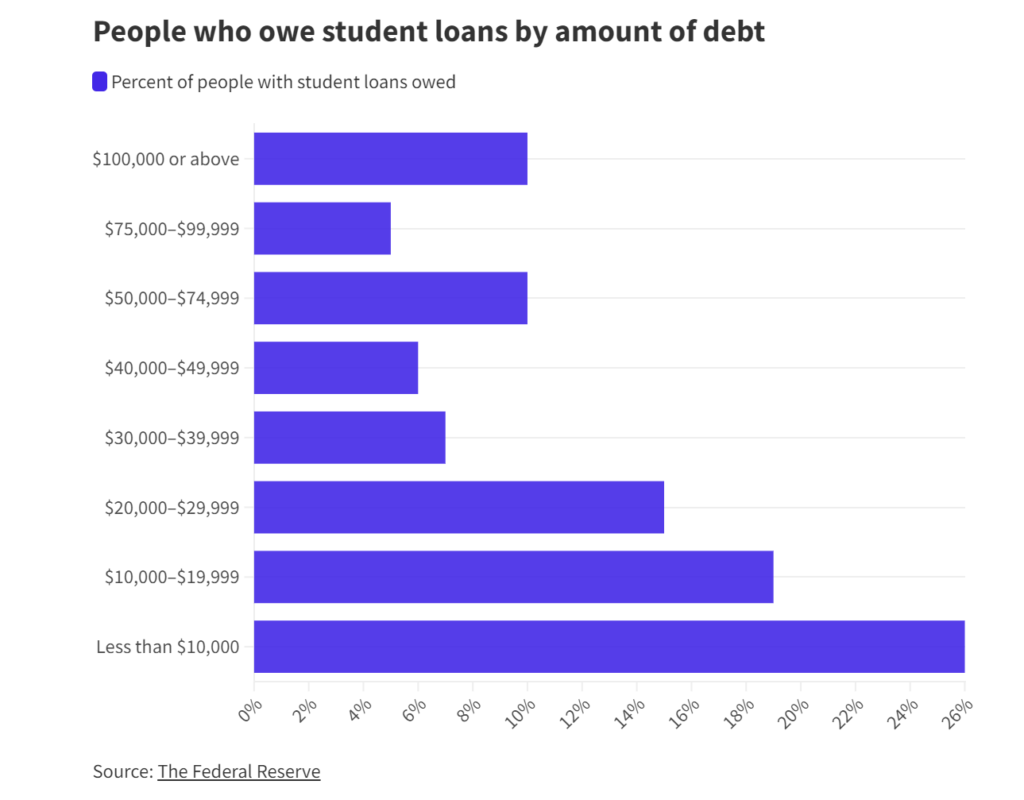

People who owe student loans by amount of debt

Diverse Due Dates

While due dates vary among borrowers, the majority are set to resume payments within the current month, ushering in an era of financial recalibration for millions of Americans.

Also Read: Stock Market Highlights – Key Moves and Analyst Recommendations

The Weight of Student Debt

The staggering student loan debt in the U.S. has surged by a staggering 66% over the past decade, surmounting a colossal $1.77 trillion, as reported by the Federal Reserve. Recent data from the 2020-2021 academic year underscores the magnitude of the issue, revealing that over half of bachelor’s degree recipients from both public and private four-year institutions graduated with student loans. The average debt burden for these graduates stood at $29,100, as per the College Board.

Inequities in Debt Ownership

Diving deeper into the realm of student debt ownership, disparities emerge along racial and gender lines. On average, Black Americans bear a heavier burden of student debt compared to their white counterparts. This divide becomes more pronounced when dissected by gender, with Black women and white women shouldering more debt than Black men and white men. Worryingly, research shows that Black women grapple with slower debt repayment, compounding the challenges they face.

Exploring the Root Causes

Multiple factors contribute to the gender and racial disparities in student debt. Gender wage gaps, predominantly in fields with lower wages dominated by women, play a pivotal role. Gender discrimination in the labor market and lower rates of family college savings for daughters further exacerbate these disparities. For Black Americans, racial wage gaps, labor market discrimination, and the longstanding racial wealth gap amplify their struggles with student debt, driven by limited family savings for higher education.

Also Read: United States Sovereign Credit Rating at Risk Amid Looming Government Shutdown

Impact of Relief Measures

Relief measures such as the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) provided a lifeline to student borrowers by temporarily suspending loan repayments throughout 2021. This intervention had a significant impact, substantially reducing the number of borrowers falling behind on payments. In 2021, only 12% of adults with student debt were behind on payments, compared to 17% in the fall of 2019. However, the Federal Reserve’s data revealed that borrowers with lower educational attainment and those attending private for-profit institutions were more likely to experience payment delinquency.

As the nation braces for the resumption of student loan payments, the student debt crisis continues to cast a long shadow over the financial well-being of millions, demanding concerted efforts and innovative solutions to alleviate this pressing issue.

One Comment